An award winning compliance solution for UAE businesses

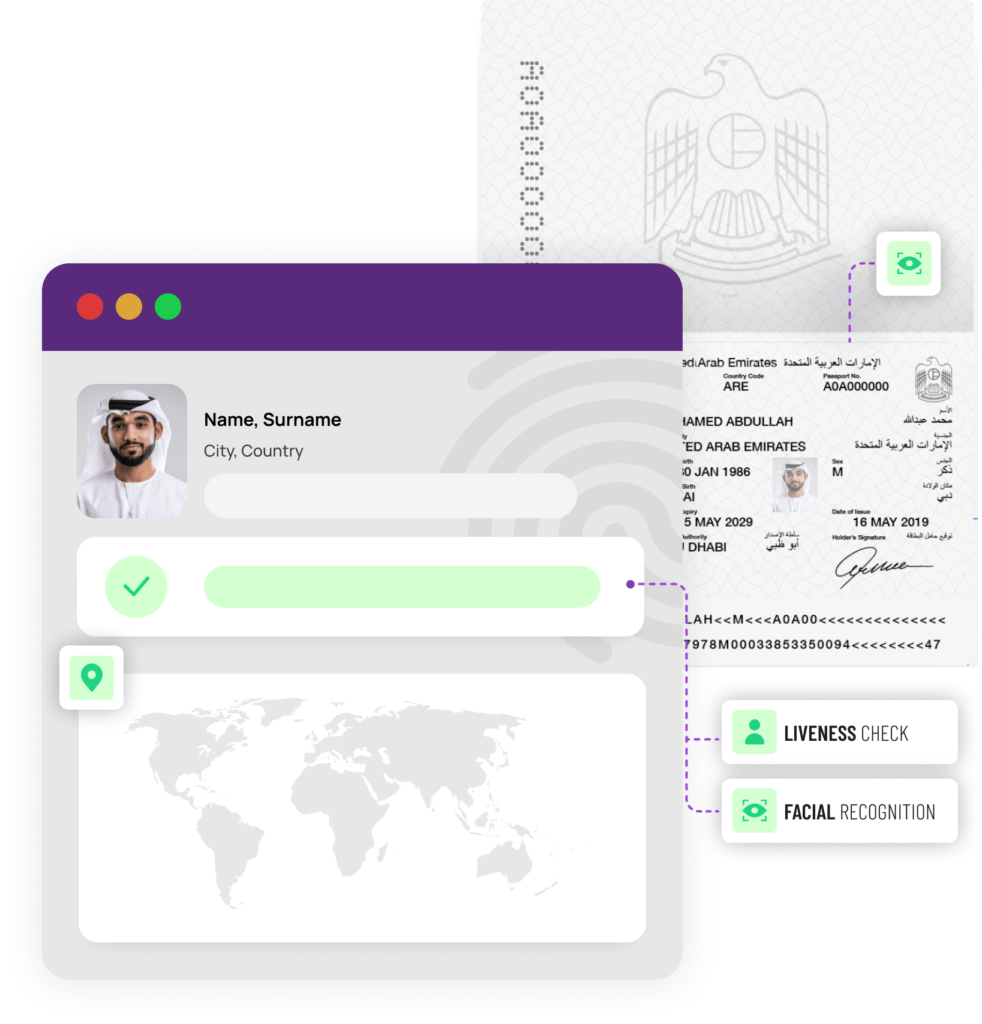

Idenfo Direct’s industry leading KYC/AML compliance solution screens your customers with speed and accuracy.

Now supporting KYC for businesses in UAE

In today’s increasingly complex regulatory environment, it’s more important than ever to ensure that your business is fully compliant with UAE laws and regulations. Idenfo Direct understands the challenges that businesses in the UAE face when it comes to KYC and AML compliance, that’s why we’re here to help. By leveraging the latest digital onboarding solutions, we provide a streamlined customer journey that simplifies the compliance onboarding process for your business. Making it as easy as possible to carry out AML/KYC and IDV checks, so you can focus on running your business smoothly.

SEAL VERIFICATION

The Idenfo Direct Verified Seal helps you showcase the credibility of your business by highlighting that you are fulfilling AML/KYC regulations.

This Seal will help you enhance the credibility of your business online and allow you to win more business opportunities.

Compliance

The National Committee for Combating Money Laundering and the Financing of Terrorism and Illegal Organizations (NAMLCFTC) oversees the national risk assessment process.

NEW REGULATIONS

As per the recent AML-CFT Act of Parliament, the UAE has introduced new regulations regarding digital ID for Customer Due Diligence (CDD).

Documents we support

Residents

Emirates ID cards

Emirates IDs issued by the Federal Authority for Identity and Citizenship.

Passports

Passports issued by the General Directorate of Residency and Foreigners Affairs / Citizenship Departments (GDRFA) to verify the nationality, name, and DOB of customers.

Proof of Address

Verification of documents related to residential details.

Non-Residents

Passports

Passports issued by country of birth to verify identity and perform risk assessment.

Proof of Address

Verification of documents related to residential details.

Visas

for non-residents only

Risk-free customer onboarding

Idenfo Direct’s KYC and AML compliance is an affordable digital onboarding solution for accountants, insurers and auditors.

We ensure effective and risk-free KYC identity verification, online ID checks, and AML compliance . With added features such as a dedicated relationship manager and on site support for all your compliance needs.You can rest assured knowing that your data is safe and hosted only within the UAE.

AML AND KYC REGULATIONS IN THE UAE

Effective navigation and implementation of Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance in the UAE, calls for the thorough understanding of the regulatory framework at hand.

12 STRATEGIC GOALS TO FIGHT MONEY LAUNDERING

The UAE is fully dedicated to combating financial crimes, with the National Committee for Anti-Money Laundering and Combatting the Financing of Terrorism and Financing of Illegal Organizations (NAMLCFTC) spearheading the effort through twelve strategic goals focused on AML and CFT.

Consulting service for Anti-Money Laundering

Utilize our anti money laundering consulting service to conduct a comprehensive risk assessment process and evaluate the potential threats of money laundering and terrorism financing to your business.

Stay ahead of regulatory compliance with our diverse solutions:

PEP Check

Gain access to a vast array of comprehensive data sets, derived from government sources, enabling you to easily detect politically exposed persons and any closely associated individuals.

Sanctions Check

Conduct rigorous screenings against updated government regulatory and law enforcement watchlists, along with over 100 International and National Sanctions lists, to ensure compliance with the latest regulations.

Adverse Media Check

Access an AI-driven analysis of news related to financial crime and money laundering to facilitate due diligence efforts.

ID Verification

Using our ID and FaceMatch checking measures you are able to confirm if a person is really who they say they are.

Know Your Business Check

Uncover the relationships between individuals and business entities using our powerful Know Your Business (KYB) solution.