Idenfo Direct won Best Regtech Solution Award at the MENA Fintech Association Awards 2024

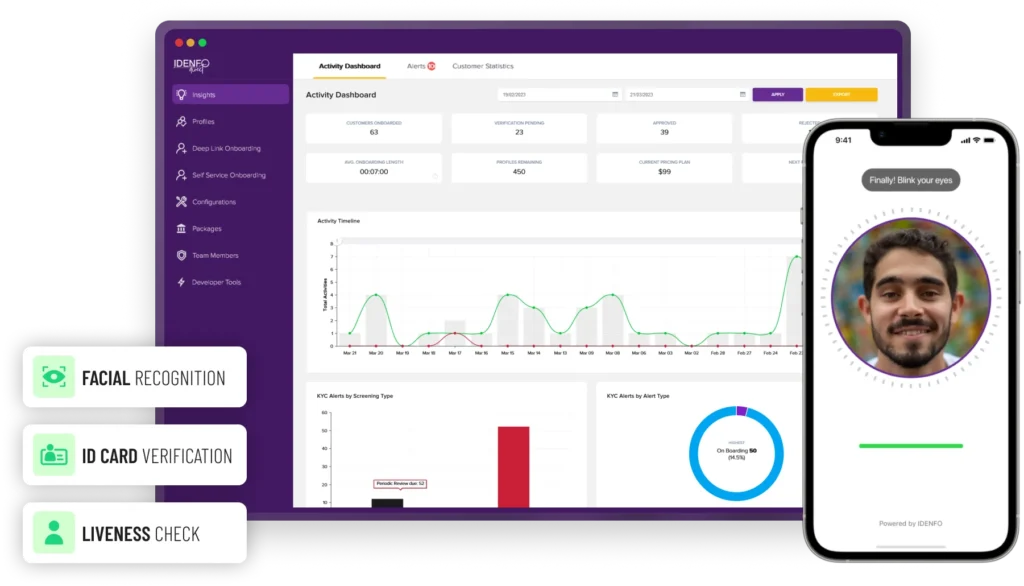

Simplify identity verification

Built for Security. Designed for Simplicity.

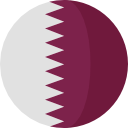

Our identity verification and AML/KYC platform combines cutting-edge technology with classic, intuitive design. Whether you’re onboarding new customers or ensuring regulatory compliance, we provide everything you need in one seamless solution.

Benefits:

- Reduce onboarding time by 80%

- Prevent fraud with AI-powered precision

- Comply with local and global regulations (FATF, FCA.)

Get seamless identity verification your way!

Choose our all-in-one platform for instant access to powerful features, or integrate our SDK to bring custom identity solutions directly into your app.

Whatever your use case, we make secure verification fast, flexible, and scalable.

Powerful Solutions Tailored to your needs

Real-Time Identity Verification

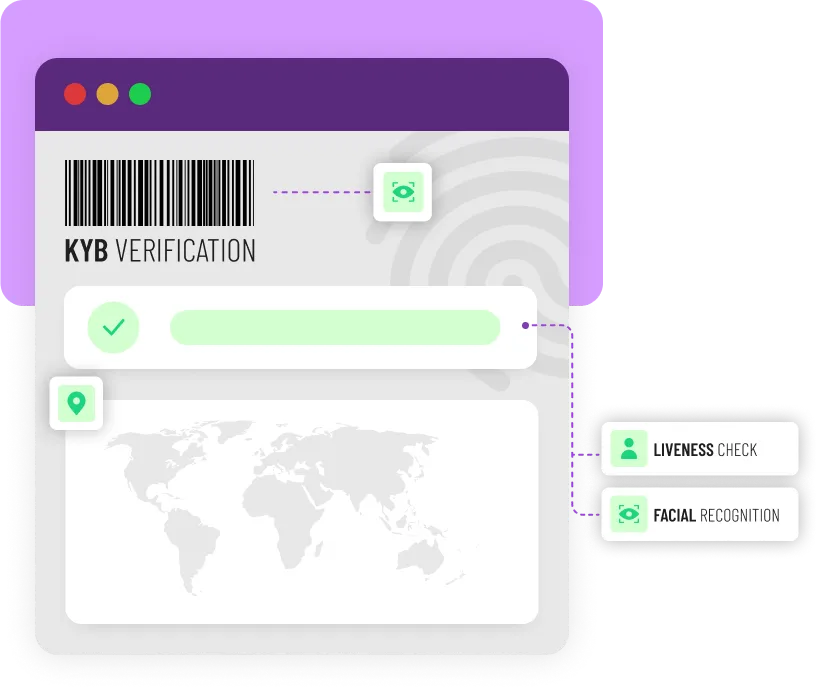

Our advanced biometrics, facial recognition, and document checks allow you to verify users in real-time. Know your customer – with up to 99.9% accuracy.

AML/KYC Compliance

From onboarding to reporting suspicious activities, keep your AML accurate, automated, and agile.

Global Coverage

Verify documents from over 200 countries and territories. Our platform supports various document types, making global onboarding simple and reliable.

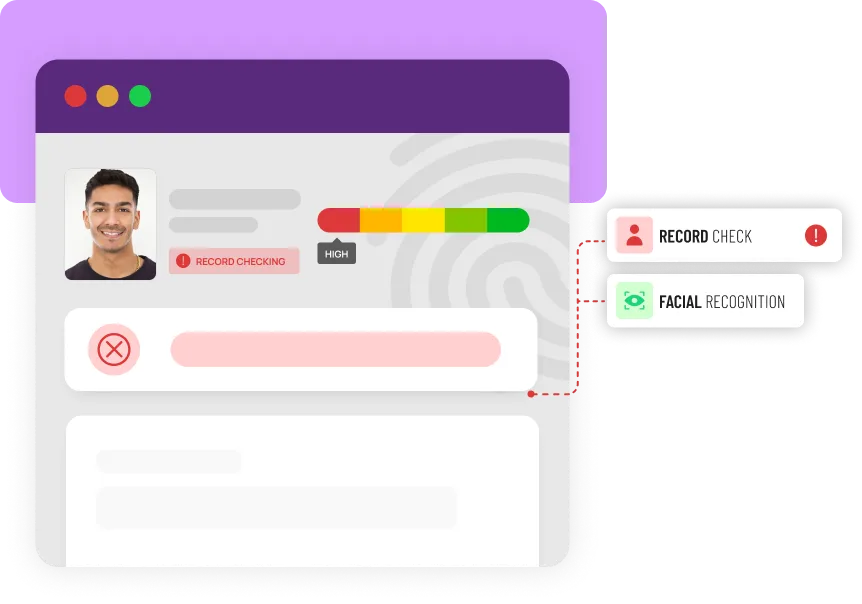

AI-Powered Fraud Detection

Leave no suspicious stone unturned: Master fraud detection with our state-of-the-art machine learning algorithms.

Seamless Integration

Easily integrate our solution with your existing systems. Your CRM, our APIs. Your platforms, our SDKs. We’ve got you covered.

How it works

Step 1

Read the document and extract identity data.

Step 2

Check the person on camera is real and matches the document.

Step 3

Verify the individual via government databases.

Step 4

Check customers are worthy of doing business with AML & sanctions screening.

Step 5

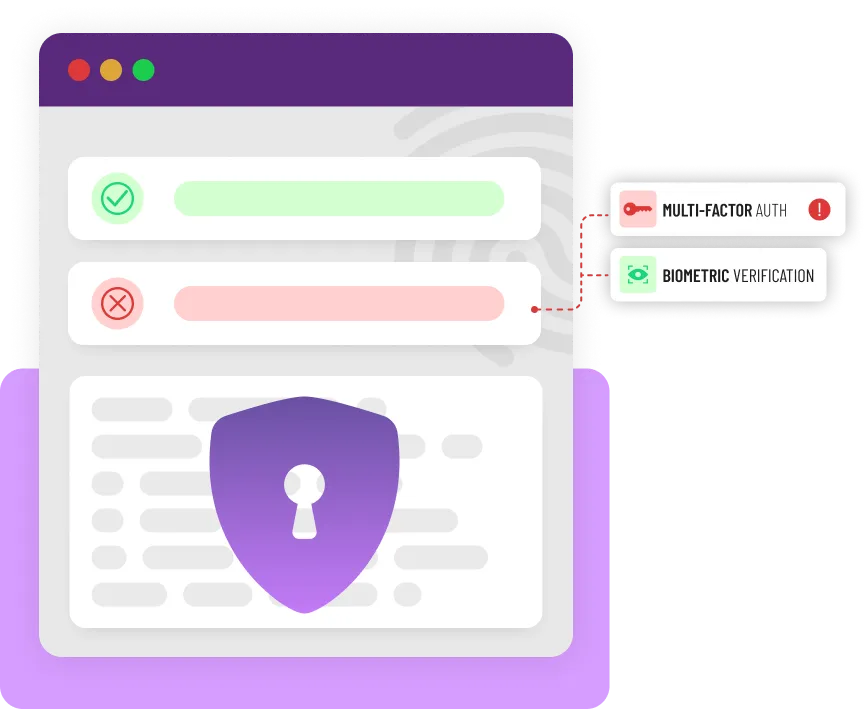

Enable passwordless login and strengthen authentication with biometrics.

Screening

AML & Sanctions Solutions

Comprehensive screening and monitoring powered by the world’s largest global risk databases, ensuring thorough checks against Monitored Lists, Politically Exposed Persons (PEPs), and Adverse Media.

Secure

Secure and Reliable Authentication Solutions

KYB Solutions

Verify and Protect Your Business

Access comprehensive screening from the largest global databases to ensure business authenticity. Identify Ultimate Beneficial Owners (UBOs), perform AML and fraud checks, and more—all in one seamless solution.

Stay Compliant, Stay Confident

Tailored AML Advisory for SMEs

Simplify your compliance journey with actionable insights, do-it-yourself tools, and expert guidance designed to protect and empower your business.

Client Testimonials

Frequently Asked Questions

WHAT IS IDENFO DIRECT?

Idenfo Direct is an affordable, subscription-based digital identity verification service. It includes fraud detection and financial crime checks such as risk rating, adverse media, and periodic reviews for various businesses.

HOW DO I SIGN UP?

You can sign up by simply entering your name, email address, and country.

CAN I VERIFY DOCUMENTS FOR ANY COUNTRY?

Yes, automatic verification checks (including facial comparison with ID cards) can be performed for any country, as long as the ID photo is clear and undamaged.

WHAT CAUSES A PROFILE TO BE TERMED 'HIGH RISK'?

While the exact algorithm is not disclosed, typical red flags include:

- Name matches on recognized sanction lists

- Non-residency in the country of application

- Nationality from a country subject to UN sanctions

IS IDENFO DIRECT GDPR COMPLIANT?

Yes, Idenfo Direct is fully compliant with GDPR regulations to ensure data privacy and security.

IS MY DATA GOING TO BE SHARED OR USED BY ANYONE ELSE?

No, Idenfo Direct does not share customer data with third-party services. Your data is treated with the utmost confidentiality and security.

IS LIVENESS DETECTION AVAILABLE AS A FEATURE?

Yes! The onboarding journey includes a video section with instructions to ensure the video is recorded live.

DO YOU CHECK SANCTIONS?

Yes, we check a wide range of sanction lists, including UN, OFAC, EU, HMT, and other regional lists.

HOW LONG DOES THE VERIFICATION PROCESS LAST?

It typically takes 2-3 minutes to input details and record a liveness check video.

WHAT IF I WANT TO CHANGE THE VERIFICATION DECISION?

A workflow exists within the system to review and, if necessary, overturn the verification result.

HOW IS THE RISK SCORING DONE?

The exact algorithm isn’t disclosed, but risk scoring considers attributes such as nationality, country of residence, work type, and other factors.

DOES IDENFO DIRECT ENSURE EFFECTIVE DATA PRIVACY?

Yes, Idenfo Direct prioritizes and implements robust data privacy measures to safeguard your information.